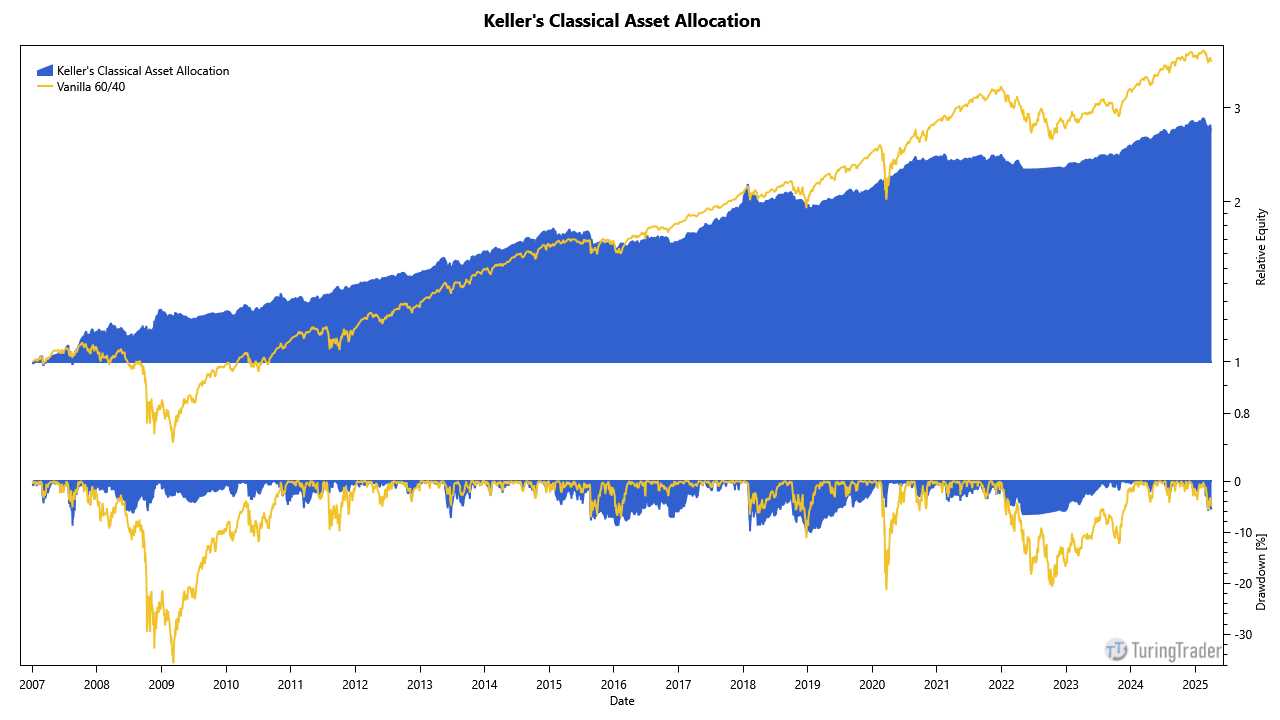

Keller's Classical Asset Allocation

This post describes a showcase for the v1 engine. Check out our showcases for the v2 engine.

In their fabulous paper Momentum and Markowitz: A Golden Combination, Keller, Butler and Kipnis describe a unique strategy: Unlike the gazillion variations of strategies based on momentum, this strategy is based on Modern Portfolio Theory.

- chart courtesy of TuringTrader.com

The authors named their strategy the ‘Classical Asset Allocation’ or CAA. That’s probably because Markowitz’ introduced MPT back in 1952. And because we designed TuringTrader’s portfolio support functionality specifically with MPT in mind, this strategy is our perfect playground.

The CAA strategy attempts to maintain an efficient portfolio, which is rebalanced monthly by performing the following steps:

- Estimate return by blending the simple momentum over 1, 3, 6, and 12 months.

- Calculate the covariance matrix, using 12 monthly bars.

- Calculate the Efficient Frontier.

- Rebalance portfolio, to achieve a fixed target volatility.

While this is quite a bit of functionality, the code for this strategy is short and concise: The main logic takes about 60 lines of code. This is possible, because we perform all of the heavy lifting behind the scenes, thanks to TuringTrader’s portfolio support.

We hope that this showcase helps you spark some new ideas. If you are just curious and like to see how well these strategies do, head over to TuringTrader.com, where we have daily updated charts.

Happy coding!